Cross-border trade has become easier, but it’s also more complex. Many businesses now source products from different countries to cut costs or expand product lines. That global reach brings opportunity but also new challenges.

One of the biggest challenges is understanding the true cost of goods. It’s not just about what you pay your supplier. The cost continues to build as products cross borders, clear customs, and arrive at your warehouse.

Landed cost gives you a full picture of what a product costs, all the way to your warehouse shelf. This clarity helps you price right, plan better, and protect your bottom line. Did you know landed cost accounts for 40% or more of the total cost per imported item? Let's understand the importance of landed cost and its challenges.

What Is Landed Cost?

Landed cost is the entire cost of bringing a product from its origin to its destination. It encompasses more than the cost of purchase.

This total cost covers:

- Product cost: Cost paid to the supplier.

- Shipping charges: Freight, handling, and delivery charges.

- Customs duties and taxes: Tariffs on imports and local taxes.

- Insurance: Against loss or damage in transit.

- Additional fees: Inspection, documentation, and port fees.

Knowledge of landed costs assists in proper pricing, budgeting, and profit margin calculation.

Companies can use landed costs to make value-based decisions regarding sourcing, price strategies, and market competitiveness. Transparency in the supply chain is assured through it, and opportunities for cost reduction can be identified.

What are the Cost Components of Landed Cost?

Landed cost includes several important components that ultimately identify the total cost of delivering an item from the point of its origin to that of its destination. These include:

1. Product Cost

This is the original price paid to the supplier for the product. It comprises manufacturing costs, raw materials, and the profit margin of the supplier. The cost of the product is the foundation on which all other landed cost elements are calculated.

2. Shipping and Freight Charges

These are the charges paid to get goods from the supplier to the buyer. The costs depend on distance, transportation mode (air, sea, or land), weight, and volume of shipment. Other fees may be fuel surcharges, terminal handling fees, and the cost of delivery to the destination point.

3. Customs Duties and Taxes

Importing goods often involves paying customs duties and taxes, which are levied by the destination country's government. These charges depend on the product's classification under the Harmonized System of Nomenclature (HSN) code, its value, and applicable trade agreements. Common taxes include Value-Added Tax (VAT), Goods and Services Tax (GST), and excise duties.

4. Insurance

Insurance guards against possible losses or damages in transit. Its cost is normally a percentage of the value of the shipment and depends on the kind of goods, means of conveyance, and coverage. Financial security against unexpected occurrences is offered by sufficient insurance.

5. Additional Fees

A number of ancillary fees may be included in landed cost:

- Handling and Packaging Fees: Fees that relate to loading, unloading, and packaging or repackaging products.

- Customs Brokerage Charges: Charges paid to brokers to enable customs clearance.

- Port and Terminal Charges: Charges for utilizing port facilities and services.

- Storage Charges: Charges for warehousing merchandise prior to final delivery.

- Documentation Charges: Charges for creating required shipping and customs documents.

- Currency Conversion and Payment Processing Charges: Charges incurred while dealing with more than one currency and foreign transactions for international payments.

Why Landed Cost is Important to Businesses?

Landed cost is more than just a number; it impacts numerous aspects of business operations. Understanding and accurately figuring out landed costs can result in increased profitability, enhanced pricing policies, and higher customer satisfaction.

Boosts Profitability

Precise landed cost calculations ensure that every cost of getting a product to market is included. This detailed knowledge allows businesses to price appropriately and meet desired levels of profit margin. Without it, firms may underprice products and suffer losses.

Improves Pricing Strategies

By understanding the real cost of a product, companies can set up pricing that is based on real costs. This visibility for competitive pricing ensures profitability. It also helps determine which products are cost-efficient to purchase and sell.

Enhances Supplier Selection

Landed cost analysis gives an understanding of the overall cost implications of purchasing from various suppliers or locations. This data is important when assessing suppliers since it identifies the most cost-efficient alternatives, taking into account all related costs beyond the purchase price alone.

Improves Customer Satisfaction

Open communication of overall costs, including duties and taxes, avoids surprise charges to customers. Such transparency minimizes cart abandonment rates and engenders trust, resulting in customer loyalty and repeat purchases.

Aids Financial Planning

Knowledge of landed costs supports proper budgeting and forecasting. It enables businesses to plan ahead for expenses, effectively manage cash flow, and make smart decisions on inventory and resource allocation.

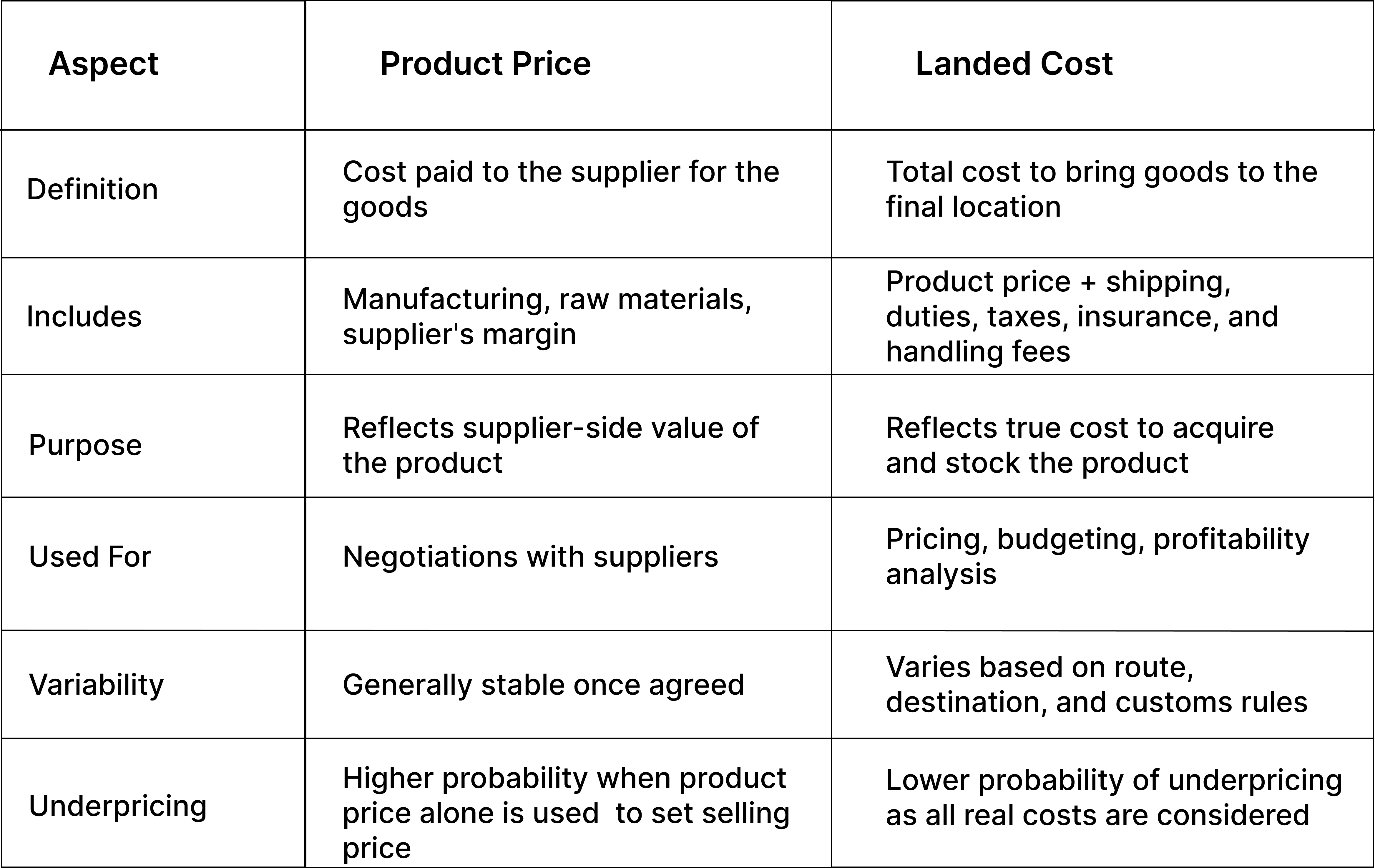

Why is Landed Cost Different from Product Price?

Product price is the amount a buyer pays to the supplier for the goods. It usually includes manufacturing costs, materials, and the seller’s margin. This price reflects the value of the product before it moves from the supplier’s location.

Landed cost, however, shows the full cost of receiving that product. These charges vary by country, shipping method, and product type.

The key difference is scope. Product price is just the start. Landed cost tells the full story of what a business spends to get the item ready for sale or use. The table below highlights the differences between the two:

How to Calculate Landed Cost?

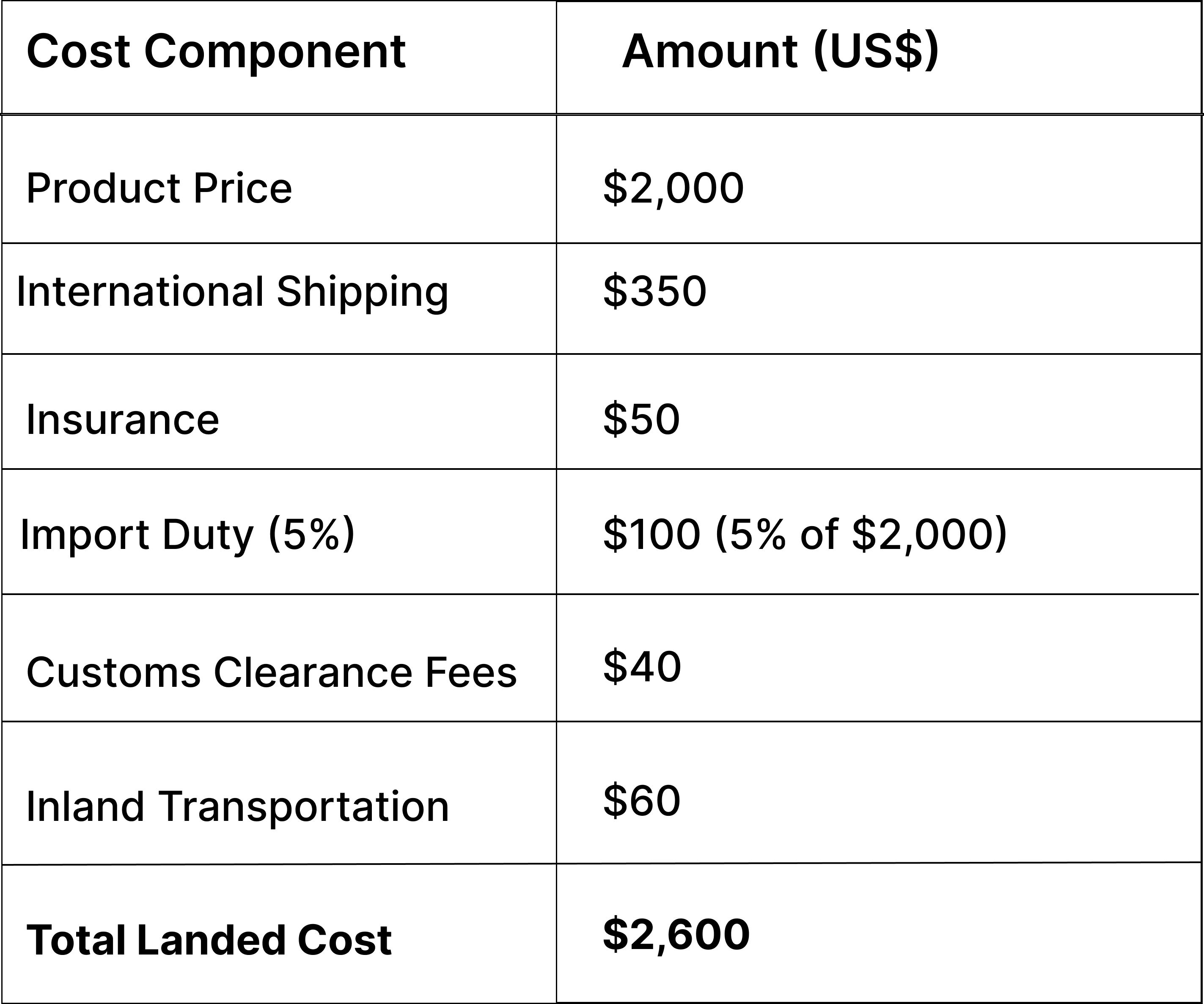

Landed cost is calculated by adding all costs for moving a product from the seller's warehouse to your warehouse. This includes the product price and any extra charges like shipping, insurance, customs duties, and handling fees.

Here’s the basic formula:

Landed Cost = Product Price + Shipping + Insurance + Import Duties + Handling Fees + Other Charges

For example, you import 100 headphones from China to the USA. Here's a sample cost breakdown:

Cost per Unit: $2,600 ÷ 100 units = $26 per headphone

This is your true cost per unit, not just the supplier’s price. Knowing this helps you set the right retail price and protect your margins.

Challenges in Calculating Landed Costs

Determining landed costs accurately is critical to successful pricing and profitability. Nevertheless, there are a number of challenges that can make this process difficult:

1. Fluctuating Exchange Rates

The value of currencies can move quickly, impacting the price of goods and services denominated in foreign currencies. These changes can cause dramatic differences in landed costs, making budgeting and forecasting challenging.

2. Variable Shipping Costs

Freight rates may also vary depending on fuel prices, demand, and other market factors. These shifts may affect the overall landed cost, particularly for companies that use international shipping.

3. Complex Customs Duties and Taxes

Import duties and taxes differ per country and product category. Tackling such complexities demands recent knowledge of global trade regulations, which can prove difficult for companies that lack specific compliance teams.

4. Concealed Fees

Unforeseen charges like demurrage (for keeping a container at a port for a longer time), port charges, or misclassified duties may arise during shipment. These additional charges can increase the landed cost and reduce profit margins if not anticipated.

5. Data Collection and Accuracy

Accurate data collection from multiple sources, such as suppliers, logistics companies, and customs agencies, is essential. Incomplete or inaccurate data can result in incorrect landed cost calculations, impacting pricing and profitability.

6. Complex Supply Chains

Companies with complex supply chains having various suppliers, modes of transportation, and intermediaries struggle to track and assign costs. This complexity may result in errors in landed costs.

7. Regulatory Changes

Regulatory changes in import/export may bring about new cost factors or modify the existing ones. Keeping updated regarding these changes is imperative to ensure the accuracy of landed cost computation.

International businesses require proper knowledge of landed costs to effectively manage business cash flow. The landing cost consists of several fluctuating elements, such that the landing cost of the same commodity exported to Vietnam and exported to Canada will be different. With this knowledge, you can adjust your pricing strategy to enhance regional profitability. The important thing in this case is to keep track of these variable fees to maximize budget and pricing. Software tools to compute landed costs make this easier by automatically calculating the costs and assisting you with profitability analysis.

Frequently Asked Questions

1. What's the difference between landed cost and product price?

The price of a product is the price you pay to the vendor for goods, which consists of costs of manufacturing, raw materials, and the supplier's profit margin. Landed cost is the combined product price with all charges incurred to get that product to its final destination, which could include shipping, customs duties, taxes, insurance, and handling costs. Knowing the differences is important when it comes to pricing and profit analysis.

2. What is the difference between landed cost and total delivered cost?

Landed cost is the concept that encompasses the entire expenditure that takes place for bringing a product to a location chosen by a buyer; such expenditure includes its purchase price, total shipping fees, duties, and any handling fees. The total delivered cost extends even further. It calculates total expenses associated with the delivery of a product to an end customer: this includes the cost of marketing, sales, and administration. This broader perspective helps the business to understand the full cost of serving the customer.

3. Can small businesses benefit from using landed cost software?

Certainly, small businesses can make use of landed cost software to automate complex calculations required for accurate cost assessments. These tools help reveal hidden expenses and enhance pricing strategies to ensure optimal profitability. With real-time visibility, such systems will allow small businesses to make informed decisions and remain competitive.

4. What is the difference between the first cost and the landed cost?

The first cost refers to the first price paid by the manufacturer or supplier for a product before consideration of additional expenses; it is exclusive of any others. Landed cost consists of the first cost and any other costs such as shipping, customs duties, insurance, handling fees, etc, associated with bringing the product to its ultimate destination. Knowing the difference is key to accurate product pricing and profit analysis.